Explore web search results related to this domain and discover relevant information.

Some VCCs did not maintain their assets with independent custodians. Apart from private equity or venture capital investments offered only to accredited investors, assets under the management of a VCC must have independent custody arrangements.

Following its thematic review of Variable Capital Companies (VCCs) and their managers based on their filings, the Monetary Authority of Singapore (MAS) issued a circular (IID 04/2025) on the key regulatory observations and supervisory expectations of the governance and management of VCCs.

Discover what venture capital is, how it works, and its vital role in funding startups and early-stage companies. Learn about investment strategies, examples and the benefits of venture funding for entrepreneurs.

Early-stage startups typically cannot access loans or capital markets directly, so they rely on VC funding instead. In exchange for VC funding, founders offer investors a percentage of ownership and perhaps a board seat. VCs can be a critical source of funding, but there are other paths you can use to achieve success. Venture capital (VC) is a type of private equity used to support startups and early-stage companies with the potential for substantial and rapid growth.In return for their investment, VC firms gain ownership stakes in the companies they support. Venture capital is typically introduced at various stages of a company's development, such as seed and early funding rounds, and plays a critical role in driving innovation and expansion across industries.In 2018, an $88 million Series A funding round was raised for Roman Health Ventures, a telehealth company focusing on men's health. By 2021, Roman Health Ventures had raised over $500 million, expanding its services and cementing its position as a leader in the telehealth industry. This investment highlights how venture capital can fuel growth and innovation in emerging sectors.The possibility of large losses - even the entire investment - is factored into the VC's business model. In fact, VCs anticipate that they'll lose money on most investments. The odds of hitting a "home run," earning over 10X the venture capital investment, is small and can take years to realize.

The Middle East's venture capital ecosystem faces a paradox: despite deep pools of capital, startups struggle to secure the funding needed to scale. Bloomberg's Laura Gardner Cuesta discusses the implications with Joumanna Bercetche on Horizons: Middle East and Africa.

Amy Wu Martin, partner at the venture capital firm Menlo Ventures, explains how consumers are turning to AI tools, chatbots and large language models for things like shopping and parenting help.

More than half of all Americans have used artificial intelligence tools recently, according to a study published by Silicon Valley venture capital firm Menlo Ventures. It found that 61% of Americans, to be exact, have used AI at least once in recent months.Marketplace’s Nova Safo spoke with Amy Wu Martin, a partner at Menlo Ventures, to learn more.“2025: The State of Consumer AI” - from Menlo Ventures

The venture capital world has always had a hot-and-cold relationship with the Midwest. Investors rush in during boom times, then retreat to the coasts when markets turn sour. For Columbus, Ohio-based Drive Capital, this cycle of attention and disinterest played out against the backdrop of its ...

The venture capital world has always had a hot-and-cold relationship with the Midwest. Investors rush in during boom times, then retreat to the coasts when markets turn sour. For Columbus, Ohio-based Drive Capital, this cycle of attention and disinterest played out against the backdrop of its own internal upheaval several years ago -- a co-founder split that could have ended the firm but may have ultimately strengthened it.For Columbus, Ohio-based Drive Capital, this cycle of attention and disinterest played out against the backdrop of its own internal upheaval several years ago — a co-founder split that could have ended the firm but may have ultimately strengthened it. At a minimum, Drive achieved something newsworthy in today’s venture landscape this past May.The AI healthcare automation company was sold to private equity firm New Mountain Capital, which combined it with two other companies to form Smarter Technologies. Drive owned “multiples” of the typical Silicon Valley ownership stake in the company, said Olsen, who added that Drive’s typical ownership stake is around 30% on average compared to a Valley firm’s 10% — often because it is the sole venture investor across numerous funding rounds.“I’m unaware of any other venture firm having been able to achieve that kind of liquidity recently,” said Chris Olsen, Drive’s co-founder and now sole managing partner, who spoke to TechCrunch from the firm’s offices in Columbus’ Short North neighborhood. It’s a meaningful turnaround for a firm that faced existential questions just three years ago when Olsen and his co-founder Mark Kvamme — both former Sequoia Capital partners — went their separate ways.

AMSTERDAM, July 07, 2025 (GLOBE NEWSWIRE) -- Theta Capital, the largest European investor in blockchain venture capital, has announced two senior hires....

Gijs Burgers, COO, Theta Capital, added, “Theta has a leading reputation in the blockchain venture capital space globally not only as an investor but also in terms of its institutional grade operational infrastructure.Founded in 2001, Theta Capital Management has been among the earliest and largest institutional investors globally to invest in blockchain technology, having deployed capital in the space since January 2018. Theta Capital works with over 45 deeply specialized VC partners leading to more than 1,000 venture style investments in the technology.Deep domain expertise has led to a leading position in the universe of crypto-native venture capital.AMSTERDAM, April 14, 2025 (GLOBE NEWSWIRE) -- Theta Capital, the largest European investor in blockchain venture capital, has published its annual report on venture capital investment in blockchain...

Venture capital (VC) is a form of private equity financing provided by firms or funds to startup, early-stage, and emerging companies, that have been deemed to have high growth potential or that have demonstrated high growth in terms of number of employees, annual revenue, scale of operations, etc.

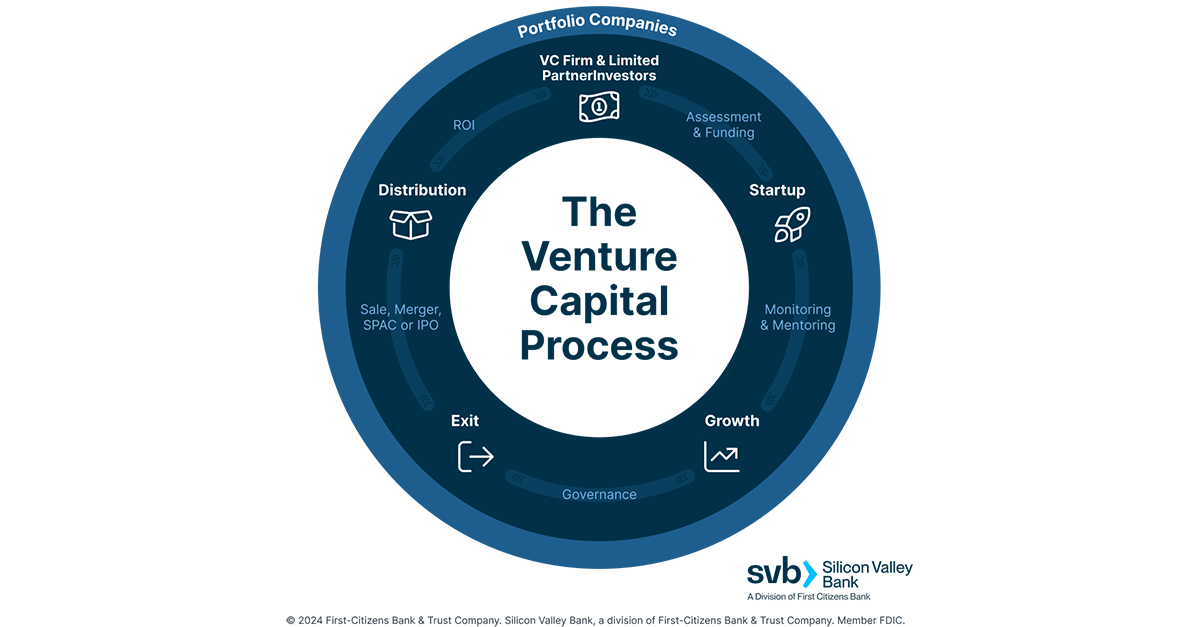

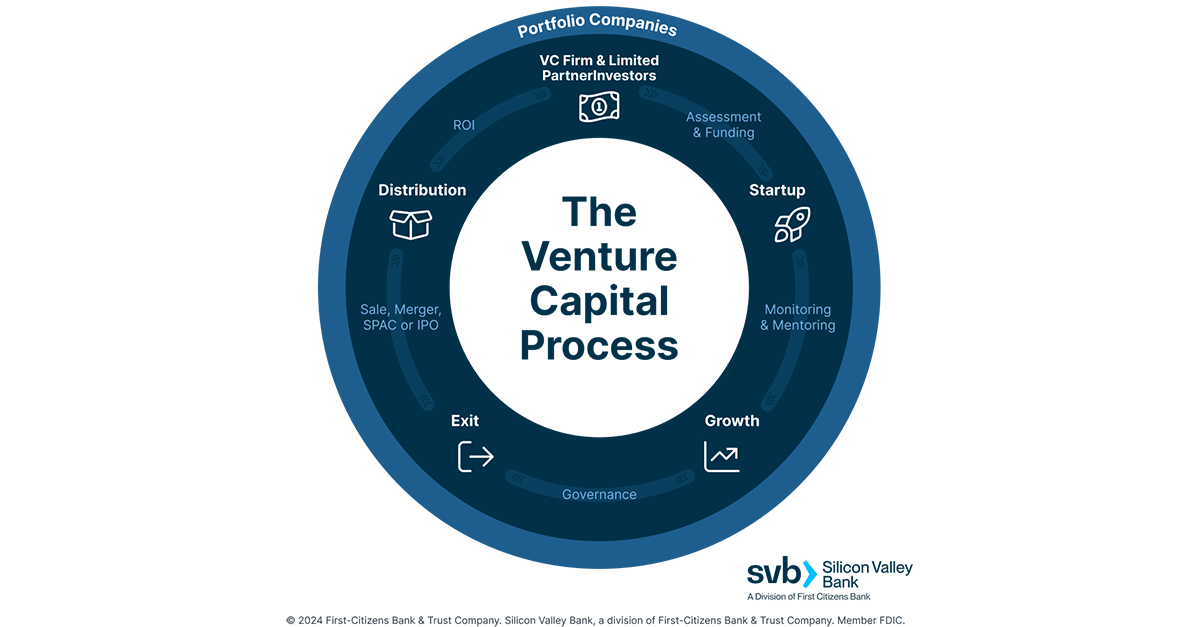

Venture capital firms or funds invest in these early-stage companies in exchange for equity, or an ownership stake. Venture capitalists take on the risk of financing start-ups in the hopes that some of the companies they support will become successful. Because startups face high uncertainty, VC investments have high rates of failure.Pre-seed and seed rounds are the initial stages of funding for a startup company, typically occurring early in its development. During a seed round, entrepreneurs seek investment from angel investors, venture capital firms, or other sources to finance the initial operations and development of their business idea.Seed funding is often used to validate the concept, build a prototype, or conduct market research. This initial capital injection is crucial for startups to kickstart their journey and attract further investment in subsequent funding rounds. Typical venture capital investments occur after an initial "seed funding" round.Venture capitalists provide this financing in the interest of generating a return through an eventual "exit" event, such as the company selling shares to the public for the first time in an initial public offering (IPO), or disposal of shares happening via a merger, via a sale to another entity such as a financial buyer in the private equity secondary market or via a sale to a trading company such as a competitor.

This week: Private-markets firms managing over $700 billion expand in the UAE, the contradiction at the heart of Abu Dhabi’s office market, and BlackRock may sell its stake in Aramco’s gas pipelines. But first, the region’s trillion-dollar capital pools are masking a venture capital paradox.

Welcome to the Mideast Money newsletter, where we chronicle the intersection of money and power in a region that's become one of the most influential in global finance. I’m Laura Gardner Cuesta, Bloomberg News’ Middle East equity capital markets reporter, filling in for Adveith Nair.

The popular mythology surrounding the U.S. venture-capital industry derives from a previous era. Venture capitalists who nurtured the computer industry in its infancy were legendary both for their risk-taking and for their hands-on operating experience. But today things are different, and ...

The popular mythology surrounding the U.S. venture-capital industry derives from a previous era. Venture capitalists who nurtured the computer industry in its infancy were legendary both for their risk-taking and for their hands-on operating experience. But today things are different, and separating the myths from the realities is crucial to understanding this important piece of the U.S. economy.In these sagas, the entrepreneur is the modern-day cowboy, roaming new industrial frontiers much the same way that earlier Americans explored the West. At his side stands the venture capitalist, a trail-wise sidekick ready to help the hero through all the tight spots—in exchange, of course, for a piece of the action.Bob Zider is president of the Beta Group, a firm that develops and commercializes new technology with funding from individuals, companies, and venture capitalists.Read more on Venture capital or related topics Finance and investing and Financial service sector

Earn unlimited miles with the Capital One Venture Rewards travel credit card. Redeem anytime with no seat restrictions or blackout dates.

Earn 5X miles on hotels and rental cars booked through Capital One Travel. Save an average of 15% on flights using price prediction and free price drop protection. Plus, get our price match guarantee on flights, hotels and rental cars. 4 ... Receive up to a $120 credit for Global Entry or TSA PreCheck®. Receive up to a $120 statement credit when you use your Venture card to apply for Global Entry or TSA PreCheck®.Eligible Venture cardholders receive complimentary Hertz® Five Star status. Skip the rental counter and choose from a wider selection of cars. ... Access dining reservations, concerts, sporting events and more. With Capital One Dining, access exclusive dining events and hard-to-get reservations at an expertly curated selection of top restaurants.Plus, you can earn 5X miles on rental cars and hotels booked through Capital One Travel. Looking for travel rewards without the annual fee? ... Receive a $50 experience credit to use at any of our Lifestyle Collection hotels or vacation rentals. 3 ... Book with your rewards, your Venture card, or a combination of the two, and get Capital One Travel's price match guarantee.Sign in to your account or use Capital One's mobile banking app to easily view redemption options. ... There's no limit to the amount of travel miles you can earn with the Venture Rewards credit card.

The deck includes data cobbled together from Pave, a compensation management tool; TrueUp, a tech jobs marketplace; and SignalFire, an early-stage venture capital firm.

Tech is hiring again, but the roles and skills in demand look different from a year ago.Redpoint Ventures' head of talent network, Atli Thorkelsson.Atli Thorkelsson, head of network at Redpoint Ventures, put together a slide deck on hiring trends.To help founders understand the situation, Atli Thorkelsson, head of talent network at Redpoint Ventures, created a slide deck on the state of tech hiring.

Venture capital fund Red Dot Capital Partners announced that it has completed raising its third flagship fund, securing total commitments of $320 million. The fund’s first closing took place in January 2024, and the final close now brings the fund to $320 million, exceeding its original target ...

Venture capital fund Red Dot Capital Partners announced that it has completed raising its third flagship fund, securing total commitments of $320 million. The fund’s first closing took place in January 2024, and the final close now brings the fund to $320 million, exceeding its original target of $250 million.Finout, Stigg, Oligo, and Bria AI are among the first bets of the new fund as the VC scales AUM to $750M.

The Unlikely Journey of One Of Silicon Valley’s Fastest-Growing Debut Venture Funds In the rapidly evolving landscape of venture capital, few stories are as remarkable as that of NFDG—a $1.1 …

In the rapidly evolving landscape of venture capital, few stories are as remarkable as that of NFDG—a $1.1 billion fund that achieved a stunning 4x return in just two years (at least on paper) — only to see its founders recruited by Meta in one of the most unusual acqui-hire arrangements in Silicon Valley history.For the broader venture capital industry, NFDG’s story raises important questions about the future of fund management, LP liquidity, and the relationship between corporate venture capital and traditional VC funds.Traditional venture capital success is measured in multiples and IRR, but the AI revolution offers something potentially more valuable: direct access to and influence over the technologies that will reshape civilization.The venture capital landscape continues to evolve rapidly, and NFDG’s story represents just one example of how traditional fund structures and investment approaches are adapting to the realities of the AI age.

Amy Wu Martin, partner at the venture capital firm Menlo Ventures, explains how consumers are turning to AI tools, chatbots and large language models for things like shopping and parenting help.

More than half of all Americans have used artificial intelligence tools recently, according to a study published by Silicon Valley venture capital firm Menlo Ventures. It found that 61% of Americans, to be exact, have used AI at least once in recent months.Marketplace’s Nova Safo spoke with Amy Wu Martin, a partner at Menlo Ventures, to learn more.“2025: The State of Consumer AI” - from Menlo Ventures

Venture capital is money, technical, or managerial expertise provided by investors to startup firms with long-term growth potential.

Financing typically comes in the form of private equity (PE). Ownership positions are sold to a few investors through independent limited partnerships (LPs). Venture capital tends to focus on emerging companies, while PE tends to fund established companies seeking an equity infusion.VC is an essential source for raising money, especially if start-ups lack access to capital markets, bank loans, or other debt instruments. Harvard Business School professor Georges Doriot is generally considered the "Father of Venture Capital." He started the American Research and Development Corporation in 1946 and raised a $3.58 million fund to invest in companies that commercialized technologies developed during World War II.Early-Stage Funding: Once a business has developed a product, it will need additional capital to ramp up production and sales before it can become self-funding. The business will then need one or more funding rounds, typically denoted incrementally as Series A, Series B, etc. The amount global VC-backed companies raised in 2023. Submit a Business Plan: Any business looking for venture capital must submit a business plan to a venture capital firm or an angel investor.These funds may be provided all at once, but more typically the capital is provided in rounds. The firm or investor then takes an active role in the funded company, advising and monitoring its progress before releasing additional funds. Exit: The investor exits the company after some time, typically four to six years after the initial investment, by initiating a merger, acquisition, or initial public offering (IPO). Many venture capitalists have had prior investment experience, often as equity research analysts.

:max_bytes(150000):strip_icc()/Venturecapital-2f7ba3a27d0545f682a6238ea6b16cb9.png)

Viet Nam is a dynamic economy with high potential for profit, so it continues to be an attractive destination for investment capital, especially from venture capital funds. Currently, there is no separate law for venture capital activities, the legal environment is still unclear, increasing ...

Viet Nam is a dynamic economy with high potential for profit, so it continues to be an attractive destination for investment capital, especially from venture capital funds. Currently, there is no separate law for venture capital activities, the legal environment is still unclear, increasing risks for both investors and startups.Venture capital funds often have a large international network, can bring Vietnamese start-ups to the region and the world through technology partners and investment funds in the following rounds or support programs from many countries around the world; this is the way for domestic inventions and scientific research to not be "buried" but have the opportunity to develop practically on a large scale.When venture capital funds participate in policy forums, they provide practical perspectives and contribute to perfecting the legal corridor, helping to improve standards and professionalise the creative startup ecosystem.Pham Tuan Hiep, Director of Innovation Projects of Bach Khoa Holdings, said that venture capital funds are smart money flow, potential startups should proactively seek these money flows and must demonstrate their profitability, growth potential in products, technology and markets for mutually beneficial cooperation.

This week: Private-markets firms managing over $700 billion expand in the UAE, the contradiction at the heart of Abu Dhabi’s office market, and BlackRock may sell its stake in Aramco’s gas pipelines. But first, the region’s trillion-dollar capital pools are masking a venture capital paradox.

Welcome to the Mideast Money newsletter, where we chronicle the intersection of money and power in a region that's become one of the most influential in global finance. I’m Laura Gardner Cuesta, Bloomberg News’ Middle East equity capital markets reporter, filling in for Adveith Nair.

Earn miles on every purchase and enjoy unlimited mile rewards with a Capital One Venture travel card.

If you’re looking for a Capital One travel rewards card that will help you earn the most miles, consider the Venture Rewards card or the Venture X Rewards card. With Venture Rewards, you can earn 2X miles on everyday purchases, plus even more on hotels and rental cars booked through Capital One Travel.And with Venture X, you can make your miles go even further. When you book through Capital One Travel, you can get unlimited 5X miles per dollar on flights and 10X miles per dollar on hotels and rental cars, plus 2X miles on every other purchase.Yes, Capital One offers travel rewards credit cards with no annual fee. VentureOne Rewards for Good Credit offers unlimited 1.25 miles on everyday purchases and even more miles on travel booked through Capital One Travel.Use miles to purchase exclusive event tickets on Capital One Entertainment. Book a flight by transferring miles to your choice of travel loyalty programs with partner airlines. Transfer miles to a loved one who also has a Venture card.

Venture capital funding in the crypto industry has shown signs of stagnation in recent months, with some firms struggling to close new funds — a trend highlighted by Sarah Austin, co-founder of the real-world asset (RWA) platform Titled, which raised a $1.3 million seed round earlier this year.

In June, several high-profile funding deals reflected this continued interest, with decentralized finance (DeFi), trading platforms, pre-seed growth funds and projects at the intersection of digital assets and artificial intelligence all securing capital. The latest VC Roundup takes a deeper look at these deals against a backdrop of seasonal volatility that could limit dealmaking in the near term. Cryptocurrency exchange Rails has revealed $20 million in venture funding across two rounds, with the most recent completed in April.The round was led by Castle Ventures, with additional participation from Bankless Ventures, Archetype, Arca, Verda Ventures and others. Beam offers stablecoin payment rails for fintechs, banks and consumer platforms, and is already live on Visa Direct, Mastercard Send and the Federal Reserve’s FedNow system. With this latest raise, Beam’s total funding now stands at $14 million. The company plans to use the new capital to expand operations in Latin America, Africa, Asia-Pacific and the European Union.Blueprint Finance, a multichain DeFi infrastructure developer, has raised an additional $9.5 million to expand its product suite, following the launch of its Ethereum-based yield platform, Concrete, and Solana-based trading and staking platform, Glow Finance. The funding round was led by Polychain Capital, with participation from Yzi Labs, VanEck, Bitpanda Ventures, BitGo, Gate Ventures and others.Rails is backed by crypto exchange Kraken, venture capital firm Slow Ventures, blockchain security firm Quantstamp and others.

Understand the ins and outs of venture capital, including how it works, the role it plays and how to raise it.

Fueling the success of early-stage startups, venture-backed and high-growth companies. ... Keep your company growing with custom banking solutions for middle market businesses and specialized industries. ... Innovative banking solutions tailored to corporations and specialized industries. ... Capitalize on opportunities and prepare for challenges throughout the real estate cycle.Innovation is a key economic driver and persistent differentiator in the United States. Many pioneering technologies, such as semiconductors, computers, the smartphone and artificial intelligence, would not exist without the risk-taking, entrepreneurship and venture capital that made them possible.Venture capital investors come in all shapes and sizes, but they generally have a long-term perspective. The time it takes for a company to grow and achieve success can be years, if not decades. From an investor perspective, success looks like an M&A or IPO transaction big enough to provide liquidity for all shareholders.However, the likelihood of any one investment resulting in a successful transaction where the return is much higher than the amount of investment, is very low. As a result, venture capitalists usually take a portfolio approach, spreading their investments across tens, if not hundreds, of companies.

:max_bytes(150000):strip_icc()/Venturecapital-2f7ba3a27d0545f682a6238ea6b16cb9.png)